Convertible Bond Arbitrage Opportunities: A Closer Look

Convertible bond arbitrage is a complex investment strategy that involves taking advantage of pricing discrepancies between a convertible bond and its underlying stock. By carefully analyzing these mispricings, investors can potentially profit from market inefficiencies.

Understanding Convertible Bond Arbitrage

Convertible bonds are debt securities that can be converted into a specified number of common shares of the issuing company.

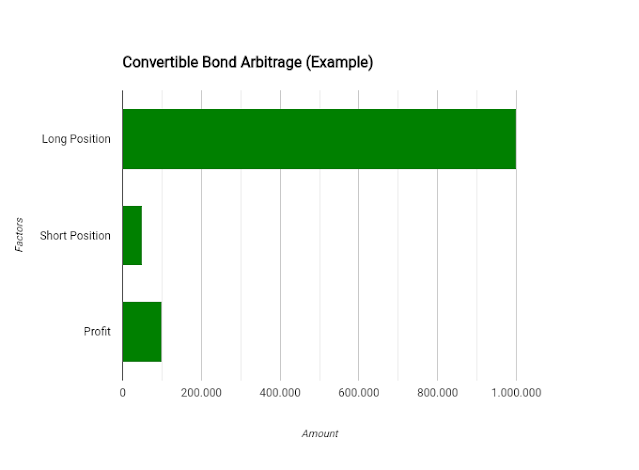

Convertible bond arbitrageurs aim to capitalize on situations where a convertible bond is undervalued relative to its underlying stock. They typically employ a strategy that involves:

- Buying the undervalued convertible bond: This long position provides exposure to both the bond's fixed-income component (coupon payments) and its potential upside from stock price appreciation.

- Short-selling the underlying stock: This short position hedges against potential losses from adverse movements in the stock price.

By executing these two trades simultaneously, arbitrageurs can create a relatively low-risk, high-reward investment opportunity.

Identifying Convertible Bond Arbitrage Opportunities

Several factors contribute to mispricings in the convertible bond market:

- Market Volatility: Periods of high market volatility can lead to temporary dislocations in pricing.

- Interest Rate Changes: Shifts in interest rates can impact the value of both the bond's fixed-income component and its conversion option.

- Changes in the Underlying Stock Price: Significant movements in the stock price can create opportunities for arbitrageurs to capitalize on pricing discrepancies.

- Corporate Events: Mergers, acquisitions, and other corporate events can trigger mispricings in the convertible bond market.

Table: Key Factors to Consider in Convertible Bond Arbitrage

| Factor | Description | Impact on Arbitrage Opportunity |

|---|---|---|

| Bond Price | The current market price of the convertible bond. | Lower prices relative to the underlying stock present opportunities. |

| Conversion Ratio | The number of shares into which each bond can be converted. | A higher conversion ratio can increase the potential upside. |

| Conversion Premium | The percentage difference between the conversion price and the current stock price. | A lower premium suggests the bond is undervalued. |

| Time to Maturity | The remaining time until the bond matures. | Longer maturities can provide more time for the arbitrage to play out. |

| Interest Rate | The coupon rate on the bond. | Higher interest rates can increase the bond's attractiveness. |

| Volatility of the Underlying Stock | The degree of price fluctuation in the underlying stock. | Higher volatility can create more opportunities for arbitrage. |

| Credit Quality of the Issuer | The issuer's financial strength and ability to meet its debt obligations. | A higher credit rating reduces the risk of default. |

Convertible bond arbitrage is a sophisticated investment strategy that requires a deep understanding of both fixed-income and equity markets. While it offers the potential for attractive returns, it also involves significant risks, including market risk, credit risk, and liquidity risk. As such, it is generally best suited for experienced investors with a strong risk tolerance.

Types of Convertible Bond Arbitrage

Convertible bond arbitrage is a complex strategy that involves exploiting mispricing between a convertible bond and its underlying stock. Here are some common types of convertible bond arbitrage strategies:

1. Cash-and-Carry Arbitrage

- Strategy: Involves buying a convertible bond and simultaneously shorting the underlying stock.

- Profit Source: Profits from the interest earned on the bond and the potential price appreciation of the bond, while hedging against downside risk through the short position in the stock.

- Table:

| Action | Effect |

|---|---|

| Buy Convertible Bond | Positive Cash Flow (Interest Income) |

| Short Underlying Stock | Negative Cash Flow (Short Sale Proceeds) |

| Profit Potential | Interest Income + Potential Bond Appreciation |

| Risk | Potential Decline in Bond Value |

2. Merger Arbitrage

- Strategy: Involves buying convertible bonds of a company that is undergoing a merger or acquisition.

- Profit Source: Profits from the potential price appreciation of the convertible bond if the merger is successful.

- Table:

| Action | Effect |

|---|---|

| Buy Convertible Bond | Positive Cash Flow (Interest Income) |

| Profit Potential | Price Appreciation of Bond Due to Merger |

| Risk | Merger Failure or Delay |

3. Volatility Arbitrage

- Strategy: Involves exploiting discrepancies between the implied volatility of the convertible bond and the implied volatility of the underlying stock.

- Profit Source: Profits from buying or selling options on the convertible bond or the underlying stock to take advantage of mispricing.

- Table:

| Action | Effect |

|---|---|

| Buy Options on Convertible Bond | Positive Cash Flow (Option Premium) |

| Sell Options on Underlying Stock | Negative Cash Flow (Option Premium) |

| Profit Potential | Profit from Volatility Mispricing |

| Risk | Adverse Movement in Volatility |

4. Event-Driven Arbitrage

- Strategy: Involves taking advantage of market inefficiencies during specific corporate events, such as earnings announcements, dividend payments, or spin-offs.

- Profit Source: Profits from buying or selling convertible bonds or the underlying stock to capitalize on price movements caused by these events.

- Table:

| Action | Effect |

|---|---|

| Buy Convertible Bond (Pre-Event) | Positive Cash Flow (Interest Income) |

| Sell Convertible Bond (Post-Event) | Negative Cash Flow (Sale Proceeds) |

| Profit Potential | Price Appreciation Due to Event |

| Risk | Event-Related Price Volatility |

Note: These are simplified explanations of complex strategies. Convertible bond arbitrage requires a deep understanding of financial markets, derivatives, and risk management. It is crucial to conduct thorough analysis and consider various factors before implementing these strategies.

Cash-and-Carry Arbitrage: A Step-by-Step Breakdown

Cash-and-carry arbitrage is a trading strategy that exploits pricing inefficiencies between the spot and futures markets for a particular asset. It involves buying the asset in the spot market and simultaneously selling a futures contract on that same asset.

Here's a simplified breakdown of the strategy:

-

Identify the Mispricing:

- Scenario: The futures price of a commodity (e.g., gold) is significantly lower than its spot price.

-

Execute the Trade:

- Buy Spot: Purchase the physical asset (gold) in the spot market.

- Sell Futures: Sell a futures contract on the same asset (gold) for future delivery.

-

Profit from Convergence:

- Hold the Asset: Store the physical asset until the futures contract expires.

- Deliver the Asset: At expiration, deliver the physical asset to fulfill the futures contract obligation.

- Profit: The difference between the higher spot price and the lower futures price represents the potential profit.

Table: Cash-and-Carry Arbitrage

| Action | Effect |

|---|---|

| Buy Spot Asset | Initial Cash Outflow |

| Sell Futures Contract | Initial Cash Inflow |

| Hold Asset to Expiration | Storage Costs and Opportunity Cost |

| Deliver Asset and Settle Futures Contract | Final Cash Inflow (Profit or Loss) |

Key Points to Remember:

- Risk Factors:

- Storage Costs: The cost of storing the physical asset can erode profits.

- Market Risk: Fluctuations in the spot and futures prices can impact the strategy's profitability.

- Counterparty Risk: The risk that the counterparty to the futures contract may default.

- Arbitrage Opportunity: The strategy is most profitable when the futures price is significantly lower than the spot price, creating a significant arbitrage opportunity.

- Market Efficiency: As markets become more efficient, arbitrage opportunities become less frequent and smaller in magnitude.

Real-World Example:

Imagine a scenario where the spot price of oil is $100 per barrel, while the futures price for delivery in six months is $95 per barrel. An arbitrageur can:

- Buy Spot Oil: Purchase oil at the spot price of $100 per barrel.

- Sell Futures Contract: Sell a futures contract for oil delivery in six months at $95 per barrel.

- Store the Oil: Store the oil for six months, incurring storage costs.

- Deliver Oil: At expiration, deliver the oil to fulfill the futures contract.

If the storage costs are lower than the $5 per barrel price difference, the arbitrageur can profit from this mispricing.

By understanding the mechanics of cash-and-carry arbitrage, traders can identify potential opportunities and execute strategies to capitalize on market inefficiencies.

Merger Arbitrage: A Step-by-Step Breakdown

Merger arbitrage is an investment strategy that involves buying shares of a company that is being acquired and simultaneously shorting

Here's a simplified breakdown of the strategy:

-

Identify a Merger Deal:

- Due Diligence: Research and analyze the details of the proposed merger, including the terms of the deal, the expected timeline, and potential risks.

-

Buy the Target Company's Stock:

- Purchase Shares: Buy shares of the company being acquired (the "target") at the current market price.

-

Short the Acquiring Company's Stock:

- Sell Short: Sell shares of the company acquiring the target (the "acquirer") that you don't currently own, with the intention of buying them back later at a lower price.

-

Profit from Convergence:

- Price Convergence: As the merger nears completion, the market price of the target company's stock should converge towards the offer price.

- Cover the Short Position: Buy back the shares of the acquirer's stock at a lower price to close the short position.

- Realize Profit: The difference between the purchase price of the target's stock and the sale price of the acquirer's stock, adjusted for any transaction costs and financing costs, represents the potential profit.

Table: Merger Arbitrage

| Action | Effect |

|---|---|

| Buy Target Company's Stock | Initial Cash Outflow |

| Short Acquirer Company's Stock | Initial Cash Inflow |

| Hold Positions Until Merger Completion | Potential Financing Costs and Market Risk |

| Cover Short Position and Sell Target Stock | Final Cash Inflow (Profit or Loss) |

Key Points to Remember:

- Risk Factors:

- Deal Risk: The risk that the merger may not be completed due to regulatory hurdles, shareholder opposition, or other unforeseen factors.

- Market Risk: Fluctuations in the stock prices of both companies can impact the strategy's profitability.

- Financing Costs: If the strategy requires borrowing to finance the purchase of the target's stock, interest costs can erode profits.

- Arbitrage Opportunity: The strategy is most profitable when the market price of the target company's stock is significantly below the offer price.

- Market Efficiency: As markets become more efficient, arbitrage opportunities become less frequent and smaller in magnitude.

By understanding the mechanics of merger arbitrage, investors can identify potential opportunities and execute strategies to capitalize on market inefficiencies. However, it's important to conduct thorough research and consider the risks involved before implementing this strategy.

Volatility Arbitrage: A Step-by-Step Breakdown

Volatility arbitrage is a complex trading strategy that exploits discrepancies between implied volatility (IV) and realized volatility (RV) of an underlying asset.

Here's a simplified breakdown of the strategy:

-

Identify the Mispricing:

- Overpriced Implied Volatility: If the market is overestimating future volatility, options are overpriced.

- Underpriced Implied Volatility: If the market is underestimating future volatility, options are underpriced.

-

Construct a Strategy:

- Overpriced IV: Sell options to profit from the decline in implied volatility.

- Underpriced IV: Buy options to profit from the increase in implied volatility.

-

Hedge the Position:

- Delta-Neutral: To mitigate the impact of underlying price movements, a volatility arbitrageur often constructs a delta-neutral portfolio. This involves buying or selling the underlying asset to offset the option's delta exposure.

-

Monitor and Adjust:

- Rebalance: As the underlying asset's price and implied volatility change, the arbitrageur may need to rebalance the portfolio to maintain the desired delta and volatility exposure.

- Exit the Position: When the implied volatility converges to the realized volatility, or when market conditions change, the arbitrageur can close the position.

Table: Volatility Arbitrage

| Action | Effect |

|---|---|

| Sell Overpriced Options | Initial Cash Inflow (Option Premium) |

| Buy Underlying Asset (to hedge) | Initial Cash Outflow |

| Hold Position | Potential Profit from Declining Implied Volatility |

| Close Position | Final Cash Inflow (Profit or Loss) |

Key Points to Remember:

- Risk Factors:

- Market Risk: Fluctuations in the underlying asset's price and implied volatility can impact the strategy's profitability.

- Model Risk: The accuracy of the model used to estimate future volatility is crucial.

- Transaction Costs: Transaction costs, including brokerage fees and bid-ask spreads, can erode profits.

- Arbitrage Opportunity: The strategy is most profitable when there are significant discrepancies between implied and realized volatility.

- Market Efficiency: As markets become more efficient, arbitrage opportunities become less frequent and smaller in magnitude.

Real-World Example:

Imagine a scenario where the implied volatility of an option on a stock is significantly higher than the historical volatility of the stock. An arbitrageur can:

- Sell Options: Sell options on the stock, collecting the option premium.

- Hedge the Position: Buy or sell the underlying stock to offset the option's delta exposure.

- Monitor and Adjust: Continuously monitor the implied and realized volatility, and rebalance the position as needed.

If the implied volatility declines as expected, the arbitrageur can profit from the difference between the initial premium received and the cost of hedging and closing the position.

Volatility arbitrage is a complex strategy that requires a deep understanding of options pricing, statistical modeling, and risk management. It's important to conduct thorough research and consider the risks involved before implementing this strategy.

Event-Driven Arbitrage: A Step-by-Step Breakdown

Event-driven arbitrage is a trading strategy that capitalizes on market inefficiencies created by specific corporate events, such as mergers and acquisitions, spin-offs, and restructurings.

Here's a simplified breakdown of the strategy:

-

Identify the Event:

- Corporate Actions: Look for announcements of mergers, acquisitions, spin-offs, or other significant corporate events.

- Market Inefficiencies: Identify situations where the market may not have fully priced in the impact of the event.

-

Analyze the Event:

- Due Diligence: Conduct thorough research to assess the potential impact of the event on the company's stock price.

- Risk Assessment: Evaluate the likelihood of the event occurring and the potential risks involved.

-

Execute the Trade:

- Buy or Sell: Depending on the specific event and market conditions, buy or sell the affected securities to profit from the expected price movement.

- Hedge: Use hedging strategies to mitigate risk, such as options or futures contracts.

-

Monitor and Adjust:

- Track the Event: Continuously monitor the progress of the event and any news or developments that may impact the stock price.

- Rebalance: Adjust the position as needed to optimize the risk-reward profile.

Table: Event-Driven Arbitrage

| Action | Effect |

|---|---|

| Identify Event | No Immediate Cash Flow |

| Analyze Event | No Immediate Cash Flow |

| Buy Securities | Initial Cash Outflow |

| Sell Securities | Initial Cash Inflow |

| Hold Position | Potential Profit or Loss from Price Movement |

| Close Position | Final Cash Inflow (Profit or Loss) |

Key Points to Remember:

- Risk Factors:

- Deal Risk: The risk that the event may not occur as planned, or may be delayed or canceled.

- Market Risk: Fluctuations in the stock price of the affected company can impact the strategy's profitability.

- Regulatory Risk: Changes in regulations or government policies can affect the outcome of the event.

- Arbitrage Opportunity: The strategy is most profitable when there are significant discrepancies between the expected price and the current market price of the securities.

- Market Efficiency: As markets become more efficient, arbitrage opportunities become less frequent and smaller in magnitude.

Real-World Example:

Imagine a company announces a spin-off of its low-performing division. An event-driven arbitrageur might:

- Buy the Parent Company's Stock: The market may initially undervalue the parent company's stock due to the negative perception of the spin-off.

- Short the Spin-Off Company's Stock: If the market overvalues the spin-off company's stock, the arbitrageur can short sell it.

- Profit from Convergence: As the market adjusts to the new reality, the parent company's stock price may increase, and the spin-off company's stock price may decrease. The arbitrageur can then close the positions and realize a profit.

Event-driven arbitrage is a complex strategy that requires a deep understanding of corporate finance, valuation, and market dynamics. It's important to conduct thorough research and consider the risks involved before implementing this strategy.

Conclusion: Convertible Bond Arbitrage Opportunities

Convertible bond arbitrage offers a unique opportunity for sophisticated investors to capitalize on market inefficiencies.

However, it's crucial to recognize that these opportunities are not always readily available and require a deep understanding of complex financial instruments and market dynamics.

Key factors influencing convertible bond arbitrage opportunities include:

- Market Volatility: Periods of high market volatility can create significant price discrepancies between convertible bonds and their underlying stocks, providing opportunities for arbitrageurs.

- Interest Rate Environment: Changes in interest rates can impact the value of both convertible bonds and their underlying stocks, creating potential arbitrage opportunities.

- Corporate Events: Corporate events such as mergers, acquisitions, and spin-offs can trigger significant price movements in convertible bonds and their underlying stocks, leading to arbitrage opportunities.

- Credit Quality: Changes in a company's credit rating can affect the value of its convertible bonds, creating potential arbitrage opportunities.

While convertible bond arbitrage can be a lucrative strategy, it's essential to have a robust risk management framework in place. By carefully analyzing the underlying securities, monitoring market conditions, and managing risk effectively, investors can maximize the potential returns from this strategy.